Your Guide to Understanding and Leveraging These Critical Metrics

Welcome back, fellow financial adventurers! Today, let’s explore the realm of option Greeks – vital metrics that play a pivotal role in options trading. Whether you’re a seasoned trader or new to options, understanding Greeks is like having a compass guiding you through the intricate market landscape.

What Are Option Greeks?

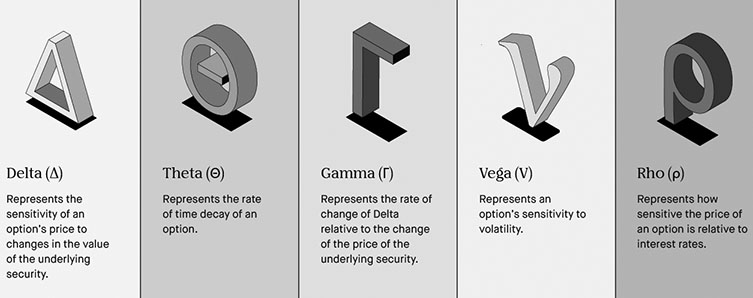

Option Greeks are mathematical measures that quantify risk and sensitivity of an option’s price to factors like changes in underlying asset’s price, time decay, implied volatility, and interest rates. In essence, Greeks help traders assess potential risks, rewards, and make informed decisions.

Delta: The Direction Indicator

Delta, often called the “holy grail,” measures an option’s price change relative to the underlying asset’s price change. For instance, a delta of 0.5 means a $0.50 change in option price for every $1 move in the underlying asset, aiding in understanding price movement. Learn more about delta here.

Gamma: The Acceleration Factor

Gamma, an options turbocharger, gauges an option’s delta change in response to underlying asset price change. High gamma values, near expiration and at-the-money, indicate quick delta changes during price movements.

Theta: The Time Decay Mechanism

Time decay matters in options trading, and theta quantifies an option’s value erosion over time. Often termed the “time decay” Greek, theta highlights value reduction approaching expiration. Be vigilant with theta, especially for longer-duration options facing time decay.

Vega: The Volatility Indicator

Volatility’s impact is crucial in options trading, and vega measures an option’s sensitivity to implied volatility changes. Wondering how an option’s price can rise while the underlying asset remains stable? Vega is the answer, essential for understanding volatility’s effect.

Rho: The Interest Rate Sensitivity

Less discussed but vital, rho quantifies option value change in response to interest rate fluctuations. Higher rho values make options more sensitive to rate changes, crucial during shifts in monetary policy or economic events.

Putting It All Together

Mastering option Greeks equips you with tools to navigate options trading complexities. Understand how each Greek affects trades, make informed decisions, adjust strategies, and manage risk effectively. Remember, Greeks interconnect and values change with market conditions, time, and volatility shifts.

With this in mind, recognize Greeks as potent tools, not mere concepts. Embrace learning, apply Greeks to real-world scenarios, and unlock trading success.

Until next time, may your trades prosper and your insights enlighten!

To your financial growth,

Niels